Title Of Proposal Governance tokens vs. Balancer governance pool

Author(s) Names The Liquidator

TLDR Summary

-

We need to introduce a token based governance system

-

Option 1: Governance tokens (gADEL, gAKRO or other name) for staking or putting your AKRO/ADEL into a Balancer/Uniswap pool

-

Option 2: Directly putting ADEL and AKRO into a Balancer pool (weights could be 50-50, 80-20, etc.)

-

I will list advantages/disadvantages below

Abstract

We need to introduce a token based governance system. There are however some problems:

-

Some people like to hold either ADEL or AKRO and not both (governance for them would be impossible via Option 2)

-

Some people don’t want to expose themselves to impermanent losses (IL)

-

The idea of ADEL was to govern DELPHI. Having the need to hold AKRO for participating in governance undermines the initial purpose of the ADEL token (DELPHI fee generation was divided into 20% for AKRO and 80% for ADEL)

-

I guess we could also introduce this fee generation split into the governance (slightly diluting the ADEL voting power by AKRO tokens).

-

if we have a governance balancer pool with AKRO and ADEL, we basically lose that AKRO/ADEL as liquidity in other places. So people who are willing to provide DEX liquidity in form of either ADEL/ETH or ADEL/USDC will not be able to participate in the governance process without pulling their liquidity out of these pools (expensive gas fees on top)

-

Special governance could be introduced to fix the problems mentioned above

Governance tokens

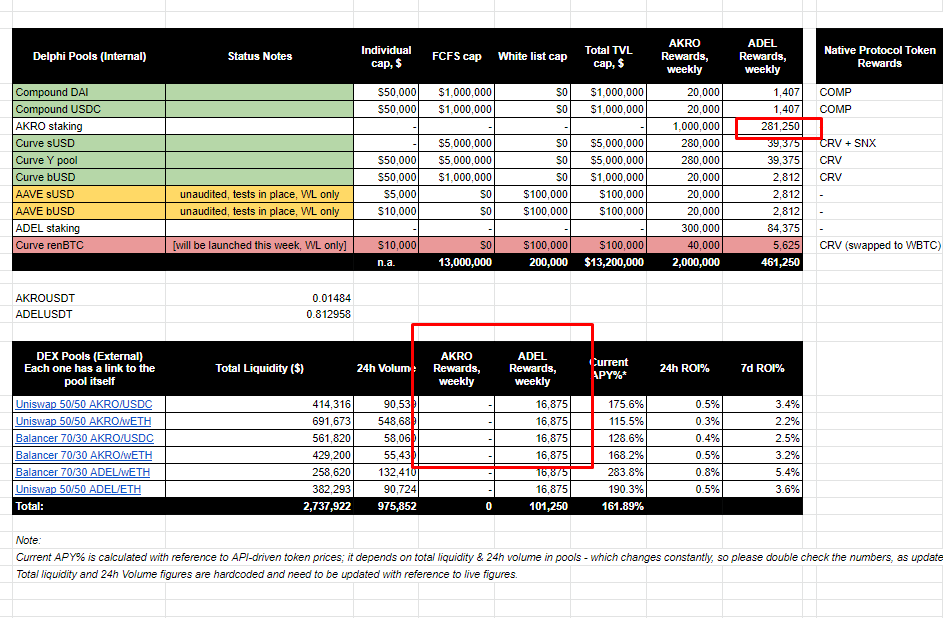

Kate mentioned that Balancer (BPT) and Uniswap LP tokens will be added to Delphi within a week.

With this, the user could either deposit/stake AKRO or ADEL tokens in the Dashboard and receive corresponding gAKRO / gADEL. The number of gov-tokens would be based on the overall/circulating supply of the tokens.

Voting weights

If you assign a voting weight to each of the tokens, you could receive a certain percentage of gov-Tokens: e.g. depositing 100 ADEL into either staking or a Balancer pool will grant you 80 governance Tokens. Depositing 100 AKRO into either staking or a Balancer pool will grant you 20 governance Tokens. (this would lead to a voting power of 80-20 ADEL/AKRO but these weights can be adjusted of course).

Rewards

The rewards for staking would be less compared to providing liquidity. Higher rewards for liquidity providers in the ADEL/ETH and AKRO/ETH pools will solve the liquidity issue we have at the moment and these liquidity providers (who take a considerable risk for IL) will be able to take part in governance as well.

If you assign a voting weight to each of the tokens, you could receive a certain percentage of gov-Tokens: e.g. depositing 100 ADEL into either staking or a Balancer pool will grant you 80 governance Tokens. Depositing 100 AKRO into either staking or a Balancer pool will grant you 20 governance Tokens. (these weights can be adjusted).

Rewards could be distributed as such for the DEX pools and less for staking only: https://gov.kaon.one/t/1-reduce-the-number-of-incentivized-dex-pools/64/7

Potential issues

The actual number of ADEL or AKRO within a Uniswap or Balancer pool might change, based on IL but the pool always readjusts to being a fixed percentage, so in my opinion you can define weighted “DEX tokens” (e.g. 70% voting power for the Balancer 70-30 ADEL/ETH or 50% voting power for the Uniswap 50-50 ADEL/ETH).

Conclusion

This would enable everyone to participate in governance (while staking ADEL/AKRO, while providing liquidity in USDC or ETH pools, etc.).

Thank you for considering ![]()