Summary

We propose to increase the maximum supply of the AKRO token under a long-term emission schedule which is transparent and predictable. All emissions will be distributed under a defined schedule and utilized for purposes including talent and partner acquisition, liquidity retention and yield generation.

This proposal has been created with careful consideration for existing and future Akropolis users and AKRO token holders. Its motivation is rooted in the ongoing success of Akropolis and the subsequent value accrual to AKRO.

Note that if this proposal does not go through, staking rewards will need to be discontinued and there will be no further incentive programs for any product from January 2022.

Abstract

If passed, this proposal will:

- Increase the maximum supply of the AKRO token under a predictable emission schedule. This will allow Akropolis to:

- Initiate the active use - and further diversification - of the Treasury;

- Introduce new revenue streams for AKRO stakers;

- Alter the mechanics of AKRO staking to promote long-term alignment of the DAO with the aims of the protocol;

- Attract and retain key talent and protocol partnerships;

- Establish new liquidity mining and staking reward programs.

- Grant the Team the power to manage the Treasury as they see fit during the transition to a DAO.

This benefits Akropolis by:

- Allowing the protocol to remain competitive as DeFi continues to evolve via a consistent capital stream; using resources to attract in-demand talent, retain liquidity and establish symbiotic partnerships across the multi-chain ecosystem;

- Creating a wider distribution of AKRO tokens to further diversify the DAO and ensure token holders are active, committed and aligned with the protocol;

- Providing a potential solution to keep liquidity within the protocol’s products;

- Harnessing a transparent and predictable emission schedule that is minimally dilutive to community governance;

This benefits AKRO holders by:

- Enabling the growth, diversification and active use of the Treasury, which will ultimately be under the control of the DAO;

- Creating new and sustainable sources of yield for stakers;

- Allowing the creation of a lock mechanism to reduce circulating supply;

- Providing new avenues to acquire AKRO which minimize market pressure;

- Facilitating the ongoing growth and success of Akropolis as a protocol.

The Numbers

A total of 1,000,000,000 AKRO (25% from Total Token Supply) tokens will be minted and gradually brought into circulation over a 4 year period. This is a 25% increase of the current total supply, which would result in a new total supply of 5,000,000,000 AKRO.

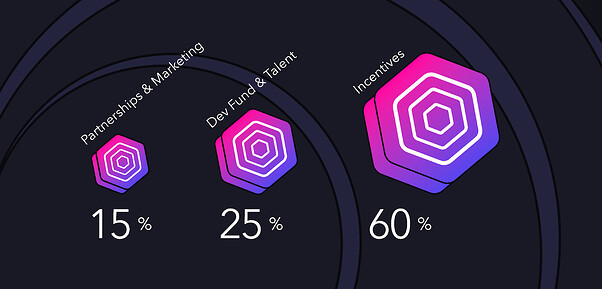

The tokens will be distributed in the following proportions:

Tokens will be released linearly over four years, utilizing the same timelock contract design we have already - releasing block-by-block with monthly claims to the Treasury address.

To put the supply increase amount into perspective, here’s a high-level breakdown of the yearly issuance rates of some other DeFi protocols:

| Protocol | Issuance Rate (%, p/a) |

|---|---|

| Osmosis | 112.86% |

| Alchemix | 42.42% |

| Balancer | 16.08% |

| Curve | 14.10% |

| Liquity | 13.11% |

In terms of increase of total supply post-distribution, this has precedent from Yearn which instigated a 20% increase, albeit with a higher allocation for Contributors than this proposal.

Rationale

Akropolis was founded 4 years ago and we have come a long way; we’ve been through a ‘crypto winter’, a project split and an exploit - but we’re still here and building. These events have, however, resulted in a depletion of the available Treasury, with scenarios that required large token allocations including:

- Almost 1.5bn tokens were sold through the pre-sale and open launch on Huobi Prime.

- Marketing, liquidity mining incentives and staking rewards.

- The ADEL swap, which was performed for the benefit of the community.

- Incentives paid to the victims of the exploit.

Remaining Competitive

The DeFi ecosystem has evolved rapidly since Akropolis’ inception and, as a result, we have seen a shift in how tokens are distributed and allocated amongst treasuries and teams.

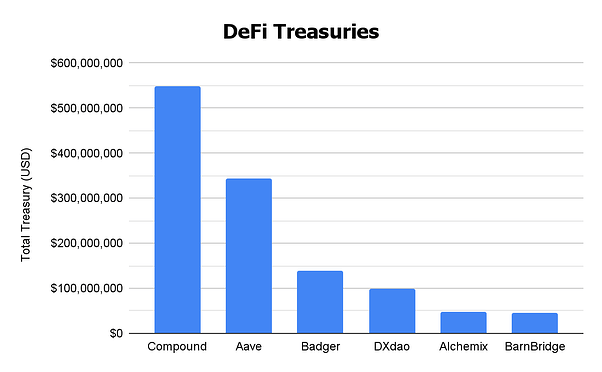

To provide context for the size of treasuries held by other DeFi protocols, see the chart below for some notable examples:

These liquid assets allow these protocols to attract and retain talent, establish partnerships through financial power and continuously ‘pay’ for liquidity. The initial Treasury started smaller, with a focus of bringing AKRO into circulation, and its contents are fully committed to the reward and compensation programs. We will use the increase in the Treasury for the above purposes too, however, we will approach each issue in a way that keeps as much value within Akropolis as possible and is motivated by the long-term adoption of DeFi, rather than just a short-term opportunistic view.

The Team at Akropolis are committed in creating products that provide sustainable and rewarding yields for users and bring substantial value to AKRO holders. The latest release, Vortex, is a prime example of this and is the first of a new suite of flagship products. Vortex has a 25% performance fee and 75% of this fee is distributed to AKRO stakers, with the remaining going to the Treasury and product contributors.

The growth of the Treasury is therefore key to achieve these goals and, ultimately, the keys for the Treasury will be in the hands of token holders via the DAO.

Attracting Talent

DeFi’s rapid evolution has led to an explosion in innovation and the on-chain space is dramatically different to what it was in 2018. We expect this to continue as new primitives are developed and each chain develops its own ecosystem. We are chain agnostic, seeing DeFi as an all-encompassing sector and, while Ethereum will always be Akropolis’ home, products and strategies will be deployed wherever they will be the most effective.

As we expand across layers and chains - and welcome the next wave of users into DeFi - we will need to grow the Team to acquire the necessary diversified skill sets. These Team members will also need to be incentivized to stay and, as these incentives will be tied directly to the success of the protocol, it makes sense for the Team to continue to accrue value for the AKRO token.

Retaining Liquidity

The issue of liquidity retention is prevalent across DeFi. Most protocols do not have sustainability in mind, but are instead paying for mercenary liquidity or trying to fend off vampire attacks from other protocols. Overall, it is an ecosystem of competition rather than collaboration.

This proposal will allow us to run new liquidity mining programs and increase rewards for AKRO stakers, but we may also introduce a ‘bonding’ mechanism for long-term protocol liquidity.

The introduction of a bonding mechanism means that Akropolis can acquire liquidity permanently as a protocol using AKRO, without having to utilize an external exchange and minimizing market impact. For the bonder, they receive AKRO at a discounted rate and are automatically enrolled in staking to generate yield from their initial deposit.

By owning the liquidity, the Treasury can manage these assets for the benefit of token stakers. Treasury liquidity will be utilized predominantly in Akropolis products and all yields generated by ‘active’ assets will be distributed to stakers; this is in addition to the current utility of fee sharing from all liquidity within the protocol.

Future DAO decisions can adjust how this liquidity is allocated, or how returns are distributed. We will go into more detail on bonding in a future blog post.

Establishing Partnerships

DeFi should be collaborative, not competitive. We are proud to be a part of the Yearn ecosystem and are already within a group of like-minded dedicated protocols. We believe that establishing more partnerships will help make all of DeFi more productive and resilient.

We will not ‘bribe’ protocols to partner with us, nor will we adopt partnerships that fail to align with Akropolis’ ambitions or product strategies. All partnerships will be made with the purpose of being symbiotic, long-term relationships and, to keep incentives aligned and further diversify the Treasury, these collaborations will likely involve direct token swaps.

An example is where we have seen great results working with MCDEX on Vortex and have recently performed a token swap with them following the philosophy above. This token swap shows commitment to the ongoing success of each other’s protocols, while also allowing Vortex users to benefit from MCDEX’s Trading Rewards program. The fruitful partnership with MCDEX will be the first of many within DeFi.

Protecting Akropolis

We are all pioneers in the DeFi space and, as with all uncharted territory, there is unforeseen risk. We as a protocol - and, by extension, AKRO stakers - do not want users to lose funds as a result of an exploit or bug. For us, security is paramount, and so we will use some of the funds from inflation to continue to acquire high-quality audits and code reviews.

Disasters can happen even with audits, however, and users are generally encouraged to seek DeFi insurance cover. Although it is important to have enough cover to make you comfortable in your position, we believe a level of coverage should be passively available to users just by using the protocol, and so we will create the ‘Staked Security Treasury’.

AKRO stakers will provide a liquidity ‘safety net’ for users of Akropolis through the Staked Security Treasury. This mechanism will exist to cover excess and unrecoverable losses from any core Akropolis product, such as Vortex, that experiences a loss event. Note that ‘loss event’ refers to unexpected exploits or bugs, not user error or strategy design.

The addition of this ‘backstop’ means additional staking rewards can be justified for AKRO stakers, while simultaneously encouraging active participation in governance decisions.

We’ll provide more details about the Staked Security Treasury in a future blog post.

Strengthening the DAO

AKRO token holders direct the future of Akropolis. For this reason, we want the DAO to be as representative as possible, with minimal centralization of power.

We believe the numerous methods we will use to distribute tokens from this proposal will ensure that AKRO is held by users who are committed and aligned with the vision of the protocol, and who will actively participate in its ongoing success. Note that we’re also exploring systems and tools to enable the DAO to work as effectively and efficiently as possible.

Minimally Dilutive

The emission schedule has been created to ensure minimal dilution to governance and establish a predictable and transparent rate. Note that tokens held within the Treasury are not currently able to create, or vote upon, governance proposals.

The increase of supply and revenue streams for staking means we can introduce another new concept - token locking.

Locked tokens will be the new dynamic for staking, introducing minimum terms but also providing access to a sustainable, scalable and increasingly lucrative revenue stream via the Treasury and other token emissions. Staking should already be seen as a long-term commitment and the introduction of locks will further ensure that stakers are aligned with the protocol and are willing to be active within the DAO.

Due to the increase in rewards and increased utility, we believe the average rate of AKRO being locked will surpass the average rate of emissions, resulting in a net decrease of the circulating supply.

The Emission Schedule

The emission schedule has been created in a way which matches Akropolis’ strategy of moving quickly and purposefully to establish and bolster its products, while also providing a consistent long-term capital stream that provides flexibility without causing significant dilution to the circulating supply within a short time period.

Specification

- 1,000,000,000 AKRO will be minted and locked in the timelock contract.

- The minted tokens will be unlocked on a block-by-block basis over 4 years with monthly claims.

- The Treasury will be managed by the Team for purposes including, but not limited to:

- Acquiring protocol-owned liquidity through AKRO bonds and swaps

- Diversifying Treasury assets through bonds, active use in DeFi products and protocol-level token swaps

- Generating additional and higher yields for AKRO stakers

- Incentivizing current and future Team members and partnerships

- Enabling additional liquidity mining and staking reward programs

- Staking will become locking. This allows the introduction of a backstop mechanism, the Staked Security Treasury, as well as higher reward rates.

Signal

You may use the forum to signal your view on this proposal. There are no binding votes, but we will use signalling for the purpose of creating discussion around the inflation itself and distribution ratios.

Note that although we envision a net decrease in circulating supply due to holders locking their tokens, there can be future governance decisions about potentially reducing the total supply as revenues increase.

FOR: The maximum supply of AKRO will increase and will be distributed as per the above schedule.

AGAINST: No AKRO will be minted. This means there will be no new liquidity mining programs, no additional incentives and staking rewards will end by the end of January, 2022.

Non-binding signalling:

- FOR: The maximum supply of AKRO will increase and will be distributed as per the above schedule.

- AGAINST: No AKRO will be minted. This means there will be no new liquidity mining programs, no additional incentives and staking rewards will end by the end of January, 2022.

BINDING VOTE:

https://snapshot.org/#/akropolis.eth/proposal/0x8221ad7a264f7a0e5bd954d8da3c8a5bdeac2e17d5cdd90a3eb092bb5ed11e25